Form 8868 is structured by IRS in a way of extension support given for 6 months to nonprofits and tax-exempt organizations in two different ways with an interval with part-1 of the IRS form 8868 supports for automatic extension for 3 months and the part-2 of the IRS form 8868 extends another 3 months conditional not automatic. There is an interval between part-1 and part-2.

Only when the part-1 as applicable with the automatic extension of time for 3 months is not enough for non-profits and tax-exempt can request through a fresh form of 8868 for part-2 as conditional extension of 3 months which is not automatic. The corporations involved in charities who required filing 990-T and coming under form 8868 as per IRS gets automatic extension of time for 6 months. Each form that represent under this 8868 should file request for extension time separately with each IRS form 8868 and no blanket requests are allowed by IRS.

The forms that come under 8868 are assigned with a separate return code which needs to be filled-in the field given corresponding to return code applying for extension time for both part-1 as automatic and part-2 as not automatic. The forms as covered under 8868 are 990-BL, 990-or 990-EZ, 990-PF, 4720, 990-T, 1041-A, 5227, 6069, and 8870.These forms will be explained in brief and in context with form 8868 in our blogs for 8868.

In the same way the individuals representing exempt-organization filing this IRS form 8868 need to fill in their Social Security Number-the SSN in the given field as identifying number and others should fill-in their Federal Employer Identification Number and both fields should not be filled-in to-gether in a form 8868.

IRS form 8868 electronic filing as available for Non-profits and Tax-exempt organizations effective January 2011 excepting form 8870 can be filed electronically requesting for the time of extension for both part-1 as 3 months automatic extension and for part-2 as additional time of extension for 3 months which is not automatic through the IRS certified partner ETAX8868.com for fast and reliable response.

Please do not request Part-2 of 8868 for additional extension time unless non-profits and exempt-organizations have been already granted with part-1 automatic extension of time for 3 months. Use separate fresh form of IRS 8868 for those who wish to take-up additional extension time when part-1 automatic extension time of 3 months is not enough.

Corporations who are required to file 990-T only can get an automatic extension of 6 months through this form 8868 can now e-file with IRS certified service provider http://www.ETAX8868.com

Only when the part-1 as applicable with the automatic extension of time for 3 months is not enough for non-profits and tax-exempt can request through a fresh form of 8868 for part-2 as conditional extension of 3 months which is not automatic. The corporations involved in charities who required filing 990-T and coming under form 8868 as per IRS gets automatic extension of time for 6 months. Each form that represent under this 8868 should file request for extension time separately with each IRS form 8868 and no blanket requests are allowed by IRS.

|

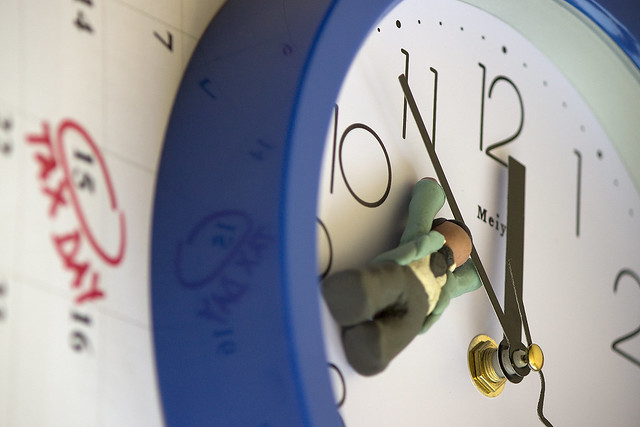

| Src: stockmonkeys.com |

In the same way the individuals representing exempt-organization filing this IRS form 8868 need to fill in their Social Security Number-the SSN in the given field as identifying number and others should fill-in their Federal Employer Identification Number and both fields should not be filled-in to-gether in a form 8868.

IRS form 8868 electronic filing as available for Non-profits and Tax-exempt organizations effective January 2011 excepting form 8870 can be filed electronically requesting for the time of extension for both part-1 as 3 months automatic extension and for part-2 as additional time of extension for 3 months which is not automatic through the IRS certified partner ETAX8868.com for fast and reliable response.

Please do not request Part-2 of 8868 for additional extension time unless non-profits and exempt-organizations have been already granted with part-1 automatic extension of time for 3 months. Use separate fresh form of IRS 8868 for those who wish to take-up additional extension time when part-1 automatic extension time of 3 months is not enough.

Corporations who are required to file 990-T only can get an automatic extension of 6 months through this form 8868 can now e-file with IRS certified service provider http://www.ETAX8868.com